![Web Desktop Hero Banner [1600×800] 24.png](/globalassets/bullion/_new_structure/discover-bullion/guides/market-updates-2023/july/monthly-article-hero-image-desktop-1600x800.png)

Precious metal prices

Towards the end of June, the precious metal market saw a substantial dip in the gold price, which plunged beneath the $1,900 benchmark for the first time in over a quarter. This depreciation was primarily attributed to robust economic data from the United States, bolstering both the dollar and the yields on bonds. Consequently, a stronger dollar diminished the appeal of gold for non-US investors, while soaring bond yields contributed to the downward pressure. Hints at potential interest rate hikes from the world's Central Banks, including the US Federal Reserve, further fuelled this downtrend.

Despite this outlook, the opening days of July brought a change of fortune as the gold market rebounded, peaking at $1,929.75 on 4 July. The investment community remained on edge, anticipating insights from the release of the Fed's meeting minutes, hinting at what the forthcoming months might bring. Although weaker US economic data and imminent job market reports swayed market sentiment, prospects of a rate hike and developments in the ongoing US-China trade conflict continued to cast their shadows on the broader market. Meanwhile, spot silver and palladium made measured strides upwards, while platinum consistently displayed an upward trajectory, rising from $897 at the end of June to $912 by the 10 July.

Central Bank Gold Reserves: Notable Shifts Amid Economic Uncertainty

As central banks navigate global economic uncertainties, their diverse responses signal a shift in gold reserve management. Despite a 27-ton drop in global reserves in May, largely due to Türkiye's notable sale of 63-tonnes, many central banks are purchasing more gold to bolster their economic defences.

The National Bank of Poland led the march by adding 19 tons to its reserves, reflecting a significant

strategy to mitigate economic risks. Similarly, the People’s Bank of China continued its gold acquisition for the seventh consecutive month, bringing an additional 16 tons into its vaults. While Türkiye's sell-off caused a dip, the broader sentiment leans towards augmenting reserves. This trend is underscored by a World Gold Council survey, predicting increased global gold reserves in the coming year.

Adding to this, a move to repatriate gold reserves has been noted, led by fear of foreign asset sanctions, as seen with Russia. Banks are shifting from derivatives or ETFs towards physical gold held domestically. This transition, underpinned by gold's safe haven status, highlights its critical role amidst escalating economic and geopolitical uncertainty.

![Article Secondary Image [1000 x 500] 18.png](/globalassets/bullion/_new_structure/discover-bullion/guides/market-updates-2023/july/monthly-article-secondary-1000x500-1.png)

Asian Gold Market Trends and Indian Market Outlook in 2023

In recent months, despite the recession seen in many countries across the world, China's gold market continues to thrive, with physical gold being sold at elevated premiums ranging from $6 to $15 an ounce above global prices, driven by concerns over the fragility of the banking sector. In contrast, India saw weak retail demand, which led dealers to offer discounts of up to $7 an ounce over official domestic price. The subdued demand in India is attributed to the end of the wedding season, lack of major festivals, and heavy rainfall discouraging buyers.

Bank of England Raises Interest Rates to 5% in Inflation Battle

In another major move in monetary policy towards the end of June, it was announced that the Bank of England was to raise the interest rate to 5% to the highest level since 2008. Before this decision was announced, markets and commentators alike were evenly split on whether the Bank would vote for a half-point increase or a smaller quarter point rise.

This move adds to the financial burden on households grappling with soaring mortgage costs. The decision came after unchanged inflation figures and the expectation that the central bank would need to respond. The Bank emphasized the persistence of inflationary pressures and stated its intention to monitor risks and raise interest rates further if necessary. Financial markets reacted by predicting a potential base rate above 6% by year-end. However, experts warned that the aggressive approach might push the UK economy into recession by reducing disposable income and dampening consumer demand.

From Vanilla to Gold: Madagascar Spices Up Reserves for a Golden Boost

Madagascar's central bank plans to boost its reserves and stabilise its currency by accumulating gold, as the decline in vanilla exports has impacted the nation's economy. The bank has received 1 tonne of gold and aims to accumulate a total of four to five tonnes from domestic small-scale miners. By diversifying reserves, Madagascar seeks to enhance competitiveness and stabilize the exchange rate. The country heavily relies on vanilla exports, which dropped by 87% in the last quarter of 2022, leading to a decline in foreign-exchange reserves and a 12% devaluation of the ariary against the dollar. As one of the country’s most vulnerable to climate risks, Madagascar aims to improve its outlook with the International Monetary Fund predicting a 4% economic expansion for the nation in 2023.

![Article Tertiary Image [1000 x 500] 5.png](/globalassets/bullion/_new_structure/discover-bullion/guides/market-updates-2023/july/monthly-article-tertiary-1000x500.png)

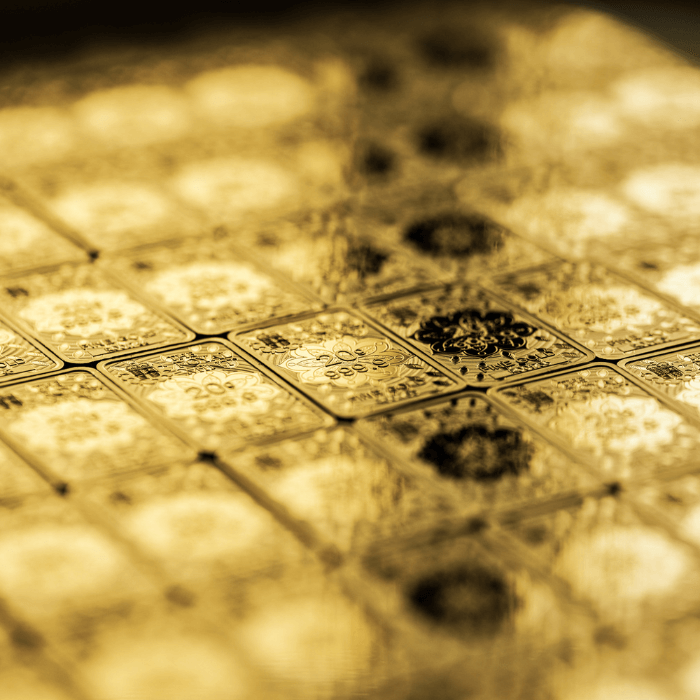

The Royal Mint Donates £47,000 to Islamic Relief

The Royal Mint has presented a cheque for over £47,000 to Islamic Relief as a result of their partnership and the sale of 20g Kaaba Gold Bullion Bars. The Royal Mint pledged to donate 2.5% from the sales of these bars during the holy month of Ramadan. The donation aims to support Islamic Relief's life-saving initiatives globally. In addition to the cheque, The Royal Mint gifted three gold bars to the charity, raising an additional sum of more than £9,000 through auctions. The 20g Kaaba gold bar, designed by Emma Noble in consultation with the Muslim Council of Wales, is available for purchase on The Royal Mint's website, and all transactions are sharia compliant.