Is it Cheaper to Buy Bullion in the Summer?

The contents of this article are accurate at the time of publishing, are for general information purposes only, and do not constitute investment, pensions, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, pensions, legal, tax and/or accounting advisers.

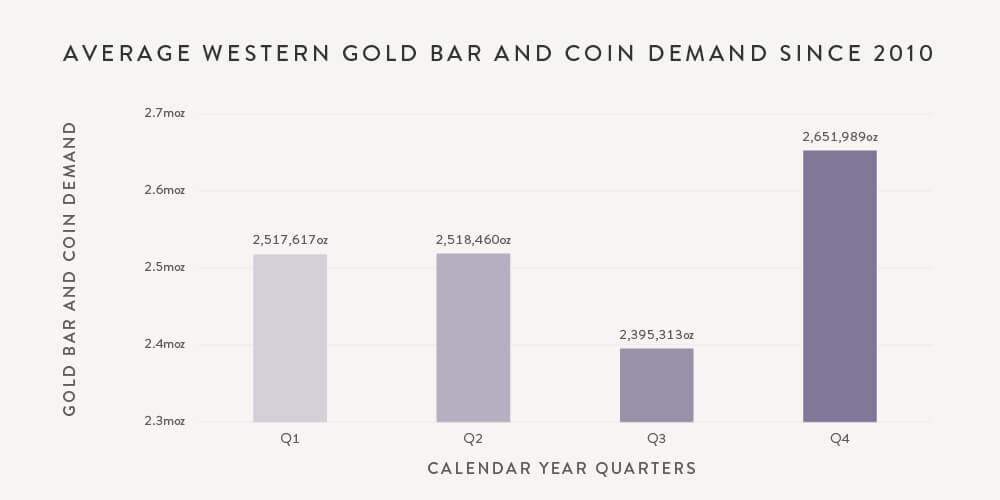

According to the recent report published by World Gold Council, since 2010, demand for bars and coins in Europe, the USA and Canada has, on average, been significantly lower in the quarter between July and September than in any other quarter.

This pattern may be caused by multiple factors. Firstly, demand for gold coins can rise in Q4 as mints often release their flagship bullion coins ahead of the new year. For example, a few 2024 coins may launch at the end of 2023. Additionally, there may be an element of coin and bar buyers buying products for Christmas, just as with many other consumer goods markets.

However, perhaps the most convincing reason for this trend may be found in the old adage ‘Sell in May and go away, come back on St Ledger’s Day’. Conventional wisdom, rightly or wrongly, suggests that stocks and shares may perform weaker in the summer months – so some investors opt to largely not touch their portfolios over the summer months until the market ‘returns to normal’ around the middle of September. To what extent this is driven by actual performance is questionable however, as there may be other draws on investors’ time and money in the summer, notably summer holidays and keeping children entertained!

Bullion buyers thinking this relative market quietness may present a good opportunity to buy should keep in mind the two factors that make up the price of a bullion product: the spot price and the product premium.

Demand for bars and coins is just one factor that affects the gold price. Wider economic and geopolitical trends, central bank buying and demand from the jewellery and industrial sectors can mean the gold price rises even when demand for bars and coins dips. At the time of writing, the LBMA gold price is 2% below the average for 2023 so far.1

In addition to the metal price, bar and coin buyers pay a ‘premium’ which covers the costs of manufacturing, marketing, shipping products, as well as providing a small profit for bullion dealers. Just as in any market, lower demand can sometimes lead to lower premiums.

The Aztecs believed that gold was the tears of the Sun. Does the data above suggest that it’s time to re-link the two and start considering gold in the summer?

References:

- Gold Demand Trends Q2 2023 | World Gold Council (Referred on 3rd August 2023)

- LBMA PM Gold Price 3rd August 2023 £1,527.23 vs 2023 year to date average of £1,557.73

- World Gold Council Gold Demand Trends, 2010-2022, total average demand from the USA, Canada and Europe.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.