Precious metals like gold, silver, and platinum have long been considered safe havens for many investors, particularly during times of economic uncertainty. Their enduring value and historical significance could make them an attractive addition to any investment portfolio. However, like any investment, precious metals come with their own set of risks and considerations that potential investors should take the time to understand.

In this article, we will explore some of the key factors which investors may want to consider when investing in precious metals. From market volatility to storage and security, we aim to provide a balanced perspective to potential investors in deciding whether investing in precious metals may be right for them. Whether you are already holding a small portfolio of precious metals or are just beginning to explore this option, it’s important to be aware of both the benefits and the potential challenges.

The Impacts of Market Volatility on Precious Metals

One of the most important factors to be aware of when investing in precious metals is market volatility. Precious metals like gold, silver, and platinum are not immune to price fluctuations as, although they are often seen as safe havens during economic downturns, their prices can be highly influenced by various factors, including global economic conditions, interest rates, and currency fluctuations.

For example, when the global economy is unstable or when there is geopolitical tension, the demand for gold typically increases as investors seek security. This can drive up prices, sometimes significantly. Conversely, in times of economic stability or when interest rates rise, the appeal of non-yielding assets like gold may diminish, which could result in the price falling.

Silver and platinum, while also valuable, can be even more volatile due to their industrial uses. Changes in industrial demand, technological advancements, or shifts in manufacturing can cause price movements in these metals.

Investors must recognise that while precious metals could provide a level of stability in a diversified portfolio, they are still subject to the same market forces that can affect any investment. Understanding these potential price swings and being prepared for them could be key to managing your precious metal investments effectively. In addition, monitoring the market and staying informed about global economic trends may help assist you in making more strategic decisions regarding your investments, for both precious metals and other assets.

Storing and Insuring Your Precious Metals

When investing in physical precious metals like gold bars or coins, two critical considerations are storage and insurance. Unlike digital investments, physical gold requires a secure place to be stored, which can present both logistical and financial challenges. Storing gold at home might seem convenient, but it can come with significant risks. Home safes can offer some protection, but they are not foolproof, and the threat of theft or damage is always present. The responsibility for ensuring adequate security normally falls entirely on the investor, and additional costs may arise from investing in high-quality safes or security systems.

For those who prefer not to store precious metals at home, professional storage solutions are available. The Royal Mint offers secure storage options, through The Vault®, where you can hold gold and other precious metals. These services not only protect your investment from theft and damage but also relieve you of the burden of managing security.

Additionally, professional storage services typically include comprehensive insurance as part of the package. This insurance coverage ensures that your investment is protected against potential risks such as theft, loss, or damage, providing peace of mind. However, it’s important to note that these storage and insurance services often come with fees and potential liability/ insurance exclusions, which can add to the overall ongoing costs of your investment.

The Liquidity of Precious Metals

Liquidity is another important factor to consider when investing in precious metals. Liquidity refers to how easily an asset can be converted into cash without significantly affecting its market value. While precious metals like gold are generally considered highly liquid, the ease of selling them can vary depending on the form of the investment.

Physical gold, such as bars or coins, particularly their fractional variants, can be sold relatively quickly. However, the process may involve finding a reputable dealer, assessing the metal’s authenticity, and agreeing on a fair price. Additionally, premiums or discounts may apply depending on market conditions, which could impact the final sale price.

On the other hand, digital precious metals, such as The Royal Mint’s DigiGold, can offer greater liquidity. These digital assets can be traded more easily, often with lower transaction costs and quicker settlement times.

When planning your precious metal investments, it’s essential to consider your liquidity needs and how easily you may need to access funds. Balancing physical and digital options within a wider investment portfolio could assist in ensuring you have the flexibility to respond to changing financial situations, both personally and within the wider market.

Counterparty Risk in Digital Precious Metals Investments

One important consideration is counterparty risk when investing in digital precious metals, such as those offered through platforms like The Royal Mint’s DigiGold. Counterparty risk refers to the possibility that the entity managing your digital investment might fail to fulfil its obligations, potentially leading to financial loss.

For example, unlike physical gold, where you normally have direct ownership of the asset, digital gold relies on the platform or provider to securely manage and store the metal on your behalf. This introduces a level of dependency on the provider's financial stability, security measures, and operational integrity.

To mitigate counterparty risk, choosing a reputable and trustworthy provider is crucial. For example, The Royal Mint, with its centuries-long history and strong reputation, offers a level of assurance that your digital investment is securely backed by physical gold, silver or platinum stored in their vaults. Understanding and evaluating counterparty risk is essential to ensuring the safety of your digital precious metal investments, providing peace of mind as you manage your portfolio.

Precious Metals and Their Tax Implications

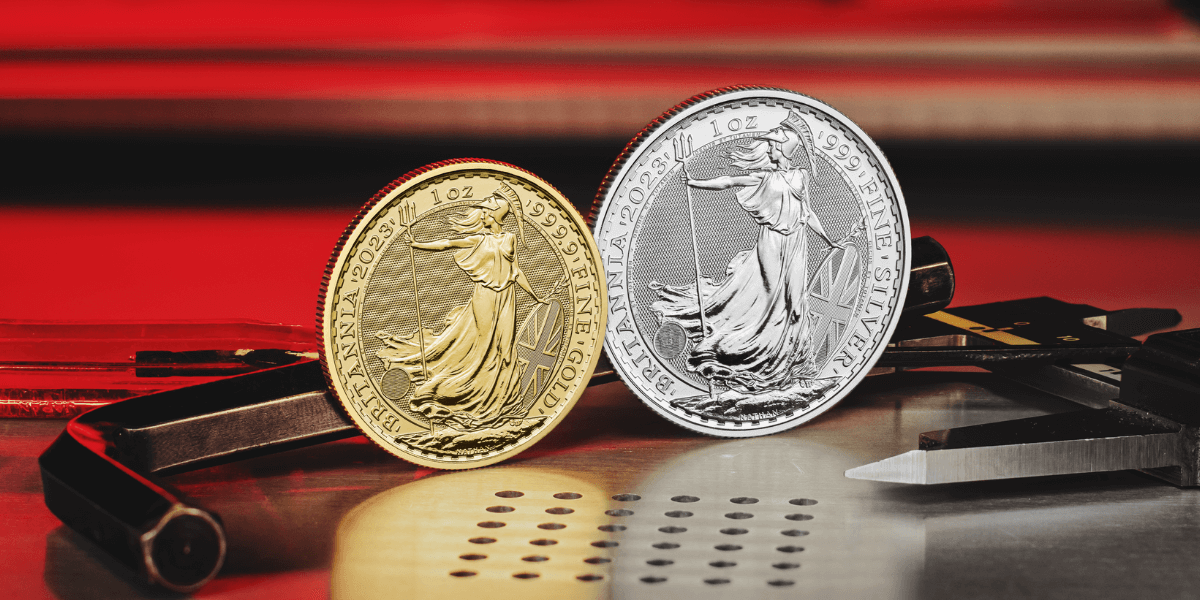

When investing in precious metals, it’s important to consider the tax implications. In the UK, gold,silver and platinum coins produced by The Royal Mint, such as The Sovereign, Britannia and its other popular coin ranges, are exempt from Capital Gains Tax (CGT) due to their status as legal tender. This can make them an attractive option for investors.

However, other forms of gold, silver, and platinum investments may be subject to taxes on gains. It’s crucial to understand the tax rules that apply to your specific investments and to consult with a tax advisor to ensure compliance and optimise your tax planning.

In Summary

Investing in precious metals may offer some benefits, but it is essential to understand the associated risks and considerations. Gaining a broader understanding of market volatility, storage, insurance, liquidity, counterparty risk, and tax implications, could help you make well-rounded decisions that align with your personal financial goals and attitudes to risk.

The contents of this article are accurate at the time of publishing, are for general information purposes only, and do not constitute investment, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.