Book an appointment

Frequently Asked Questions

Throughout most of human history, people have treasured, prized and collected gold objects and gold coins. The value lies in the precious metal itself and does not rely on external markets to determine its performance.

An investment can be seen as a risk at any time. When investing in gold it is important to pay attention to factors such as interest rates and world events, as these are the most common ways that the price of gold is affected.

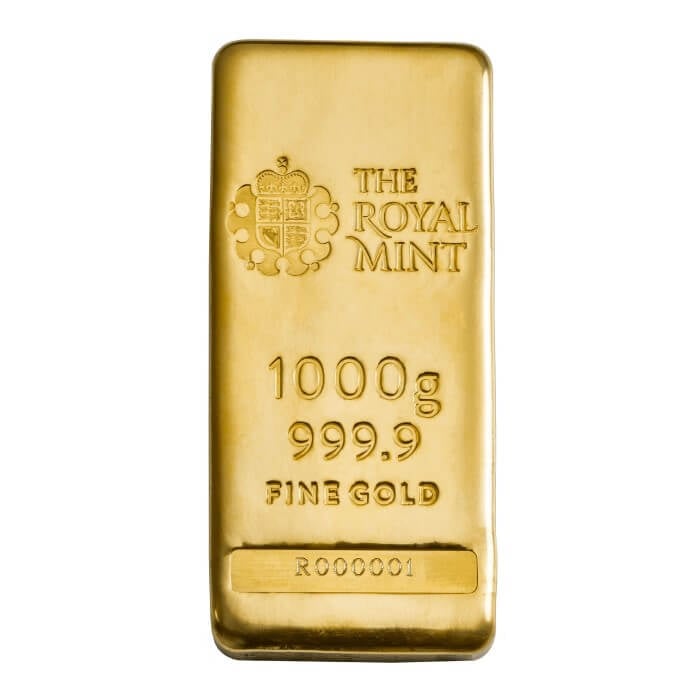

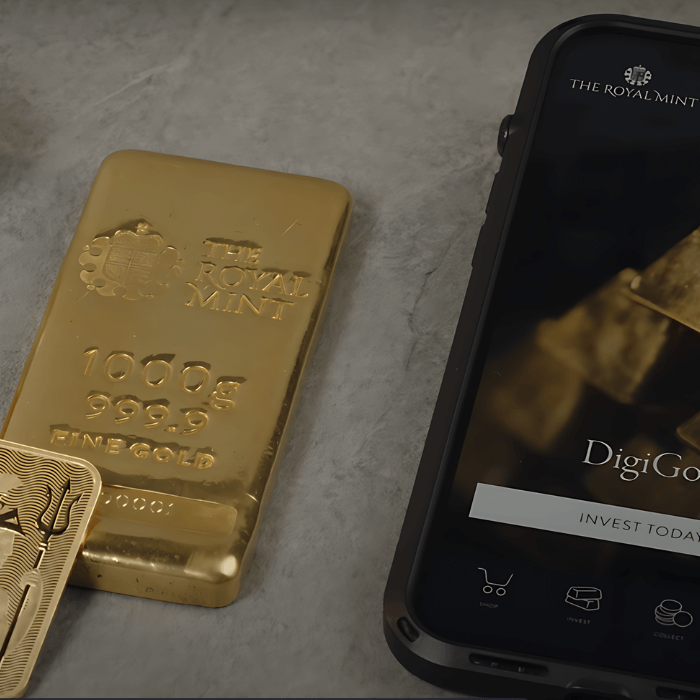

Investors can choose to invest in physical gold in the form of coins or bars, or they can invest in gold digitally, buying virtual fractions of a real gold bar.